Now Reading: Bullish Options Strategies: How Traders Profit from Rising Market

-

01

Bullish Options Strategies: How Traders Profit from Rising Market

Bullish Options Strategies: How Traders Profit from Rising Market

Options traders employ a variety of strategies depending on their outlook for the market. When the expectation is that a stock will rise, bullish options strategies come into play. These strategies range from aggressive plays that seek unlimited upside to more conservative approaches that balance profit potential with risk management.

Selling cash-secured puts can be a smart way for investors to generate income or acquire shares of a stock they already want to own at a lower price. This strategy involves selling a put option while setting aside enough capital to purchase the underlying stock if assigned. The outcome is straightforward: either the option expires worthless and you pocket the premium, or you are assigned shares at a discounted cost basis.

Why Use Cash-Secured Puts?

Cash-secured puts are a bullish strategy, though slightly less bullish than buying shares outright. Traders use them when they expect a stock to remain stable, rise modestly, or at least not fall too much.

- If you’re strongly bullish, leveraged strategies such as buying calls or call spreads may be more attractive.

- But if you want to take a more conservative, income-focused approach while keeping open the possibility of owning the stock, selling puts is a better fit.

Unlike naked put sellers, who sell options without the capital set aside (and often don’t want to own the stock), cash-secured put sellers accept that they may end up buying shares.

Example: Super Micro Computer (SMCI)

On the day of the example, Super Micro Computer (SMCI) was trading at $42.92. The October $40 put option was priced at around $1.65.

Here’s how the trade works:

- By selling one $40 put, the trader collects $165 in premium (since each option contract covers 100 shares).

- In exchange, they take on the obligation to buy 100 shares of SMCI at $40 if assigned.

- The cash required is $4,000 (strike price × 100 shares), though the premium reduces the effective cost.

If assigned, the net cost basis would be:

$40−$1.65=$38.35\$40 – \$1.65 = \$38.35$40−$1.65=$38.35

That’s a 10.65% discount to the market price of $42.92.

If the option expires worthless (SMCI closes above $40), the trader keeps the premium. The return in that case is:

$165/$3,835=4.3% in 38 days\$165 / \$3,835 = 4.3\% \text{ in 38 days}$165/$3,835=4.3% in 38 days

Annualized, that works out to about 41.3%.

Outcomes

This strategy leaves the investor with two favorable possibilities:

- Premium Income – If SMCI stays above $40, the put expires worthless and the seller keeps $165, a 4.3% return in just over a month.

- Discounted Stock Purchase – If SMCI closes below $40, the trader buys shares at an effective price of $38.35, well below the original $42.92 level.

In either case, the setup is appealing for investors who already want to own SMCI.

About SMCI

Super Micro Computer designs, develops, and sells energy-efficient server solutions built on the x86 architecture. Its product lineup includes rack-mount and blade servers, serverboards, chassis, and other systems used in data centers, high-performance computing, and storage networks. The company sells primarily through distributors and system integrators, with some sales to OEMs.

At the time of writing, SMCI carried a dividend yield of 3.56%, adding another layer of potential return for long-term shareholders.

Risks and Considerations

While cash-secured puts can generate attractive returns, they also carry risk:

- If SMCI’s stock falls sharply (e.g., below $30), the seller would still be required to buy shares at $40, locking in an immediate loss.

- Options are leveraged products, and traders can lose their entire investment if not managed carefully.

- Risk-averse investors may consider buying a protective put to limit downside exposure.

Final Thoughts

Selling cash-secured puts on SMCI offers a win-win setup: either earn 41% annualized income if the stock stays above the strike, or acquire shares at a 10% discount to current prices. For investors bullish on SMCI’s long-term outlook, this strategy is worth considering.

That said, options trading is not without risks. Start small, understand the mechanics, and always ensure you have the capital and risk tolerance to manage the assignment.

Options traders employ a variety of strategies depending on their outlook for the market. When the expectation is that a stock will rise, bullish options strategies come into play. These strategies range from aggressive plays that seek unlimited upside to more conservative approaches that balance profit potential with risk management.

Using Time Decay: The Calendar Spread

Not every bullish trader expects an immediate breakout. Sometimes the outlook is for a sideways or gradual move higher. In these cases, traders can benefit from Theta (time decay) by combining bullish and bearish options in a calendar spread. This strategy allows the trader to profit if the stock trades within a targeted range for a certain period before breaking out later.

The Most Bullish Strategy: Buying Calls

The simplest and most aggressive bullish strategy is buying a call option. This provides leveraged exposure to a stock’s upside move, allowing the trader to control 100 shares at a fraction of the cost. While the risk is limited to the premium paid, the upside potential is virtually unlimited.

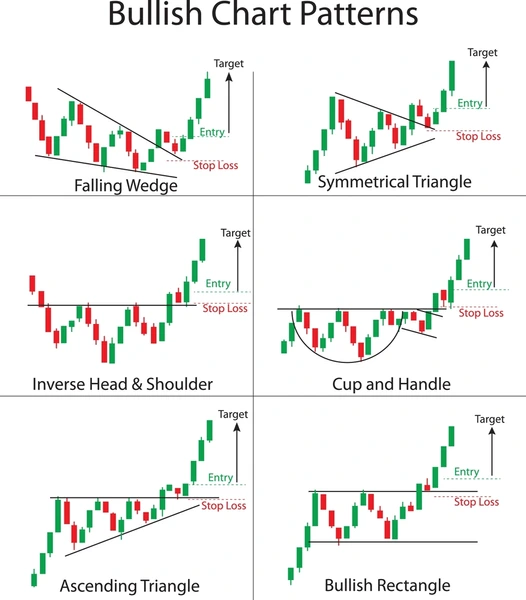

Moderately Bullish Strategies: Bull Spreads

Traders who expect a stock to rise but also want to control costs often turn to bull spreads. These strategies involve buying one option while selling another at a higher strike price.

- Bull Call Spread: Buy a call option at a lower strike and sell another call at a higher strike. This reduces cost but caps profit.

- Bull Put Spread: Sell a put option at a higher strike and buy another at a lower strike. This generates premium income with defined risk.

These spreads are popular because they provide limited risk and reduced costs, making them efficient for traders who have a target price in mind for the underlying stock.

Mildly Bullish Strategies: Covered Calls

Sometimes a trader is only slightly bullish or simply wants to generate income from a stock they already own. In this scenario, covered calls are a preferred choice.

Here’s how it works:

- The trader owns shares of the stock.

- They sell an out-of-the-money call option.

- The buyer of the call pays a premium for the right to purchase the stock at the strike price.

If the stock rises modestly, the trader profits from both the premium and potential appreciation up to the strike. If the stock doesn’t move much, the premium still provides income. And if the stock declines, the premium helps offset some of the downside.

Final Thoughts

Bullish options strategies give traders multiple ways to profit from rising stock prices, each tailored to different levels of conviction and risk tolerance:

- Calls for aggressive bullish outlooks.

- Spreads for moderate targets with controlled risk.

- Covered calls for mild optimism or income generation.

The key is matching the strategy to the market environment and your forecast. Options provide the flexibility to balance cost, risk, and reward – but success depends on choosing the right tool for the market conditions at hand.

Conclusion

Bullish options strategies offer traders a spectrum of choices, from aggressive call buying with unlimited upside to conservative income plays like covered calls. The right approach depends on how strongly you believe the stock will rise, the timeframe for that move, and your personal risk tolerance. By understanding and applying these strategies, traders can participate in market rallies more efficiently – either maximizing gains, reducing costs, or cushioning against downside risk. Ultimately, success lies in aligning the strategy with both your outlook and the ever-changing dynamics of the market.