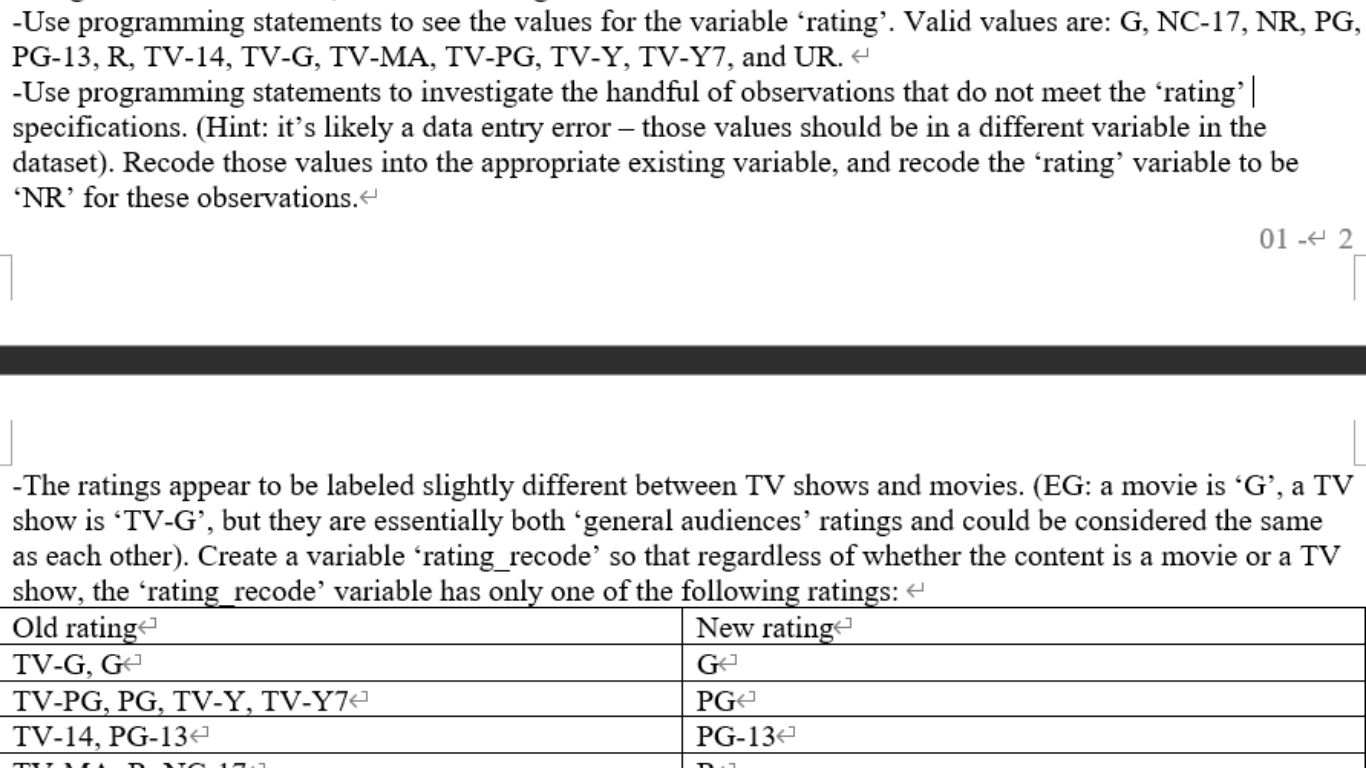

Now Reading: XRP ETF Buzz PayFi & Altcoin Excitement: What Investors Should Watch Heading Into 2025

-

01

XRP ETF Buzz PayFi & Altcoin Excitement: What Investors Should Watch Heading Into 2025

XRP ETF Buzz PayFi & Altcoin Excitement: What Investors Should Watch Heading Into 2025

Introduction

Picture this: It’s early 2025, and your crypto portfolio has just spiked-XRP ETF Buzz PayFi is finally making headlines again. But this time, it’s not because of a lawsuit or hype cycle. It’s because the long-awaited XRP ETF has been approved, and Wall Street is paying attention.

That’s not just wishful thinking—it’s a real possibility.

Crypto investors have spent years watching Bitcoin and Ethereum dominate ETF conversations. Now, XRP could be next in line, and projects like Remittix and PayFi are also stirring excitement in the altcoin investment space. Whether you’re a seasoned trader or just getting your feet wet, these trends matter.

In this post, we’re breaking down:

- Why the XRP ETF 2025 talk is heating up

- How to contact Remitix Crypto Presale

- What the PayFi trend actually means-and why it could be huge

- Tools and tips for navigating altcoin opportunities wisely

Let’s dive in.

The XRP ETF Buzz: Is 2025 the Breakout Year?

If you’ve followed XRP for a while, you know it’s been through a lot. Lawsuits, delistings, comebacks—it’s had a rocky road. But as we move closer to 2025, a new narrative is emerging: the possibility of an XRP ETF.

The reason could XRP is next in line?

Here’s what’s shifting in XRP’s favor:

- Regulatory clarity is improving. Ripple’s partial victory in court against the SEC in 2023 set a major precedent. It’s not over, but it’s a step closer to legitimacy.

- Ripple’s real-world partnerships are growing. Banks and remittance companies are still building with RippleNet, which gives XRP real utility—something most altcoins lack.

- Investor interest is building. If institutional players gain access to XRP through ETFs, expect the market to respond quickly.

What the Ripple ETF News Is Signaling

Rumors of a Ripple ETF have been brewing, especially since the SEC opened the door to Ethereum-based ETFs. Some analysts believe XRP could be next, especially for use in cross-border payments.

“We’ve seen Bitcoin and Ethereum become institutionally popular. If an XRP ETF joins the club, it would massively legitimize use-case-driven crypto,” said crypto strategist Maya Leclerc.

Watch. If an ETF is approved, XRP could see its most significant price move in years—and altcoin markets could follow suit.

Altcoin Excitement: What’s Behind It and How to Hold On to It

We’re not just seeing a potential XRP rise – there’s also a wave of innovation in the altcoin world, and investors are paying attention..

Presale Spotlight: Is Remitix the real deal?

There’s a name that’s been popping up everywhere lately: Remitix. It’s establishing itself as a next-generation remittance solution powered by blockchain. But is it worth your attention—or your money?

Here’s how to evaluate it:

- Solid use case: Remittix is targeting high-fee remittance corridors. If it succeeds, the impact could be huge.

- Transparent team & roadmap: Always look at the team’s background and whether they’ve been KYC-verified or publicly doxxed.

- Still early-stage: Like most presales, Remittix has promise, but there’s execution risk. Don’t go all in.

Bottom line? The Remittix crypto presale has potential, but it’s not a guaranteed moonshot. Treat it like any early-stage investment—with both eyes open.

What is this XRP ETF Buzz PayFi trend everyone is talking about?

PayFi, or “payment finance,” is gaining traction as the DeFi world begins to focus on real-world utility – specifically seamless, yield-producing payments.

Think of it like this: Instead of just sending crypto, what if your wallet also earned while it paid?

Projects in this space are a mix of payments, staking, and DeFi automation. It’s early days, but it’s worth exploring if you’re looking beyond simple trading.

Look for:

- Tokens tied to payment services or payroll tools

- Projects offering rewards for everyday transactions

- Platforms solving real financial bottlenecks (e.g., settlement speed, cross-border fees)

The PayFi trend might just be the “altcoin DeFi 2.0” we’ve been waiting for.

Real Returns: What’s Actually Working in Altcoins

We all know the altcoin space is full of hype—but it’s also where some of crypto’s biggest wins have happened.

XRP’s Past Resilience

When XRP was sued by the SEC in 2020, most expected it to crash. But it surprised everyone with a 120% price jump that same year. It’s a reminder: strong communities and real utility matter more than fear.

Altcoin Presale Success Stories

- Solana: Early presale investors saw over 8,000% returns by late 2021.

- Avalanche: Another sleeper hit that took off due to its performance-first architecture and real-world DeFi use.

So yes—altcoin investments can pay off. But they usually reward research, timing, and patience over hype-chasing.

Tools That Help You Stay Ahead of the Curve

In a world moving at such a fast pace, you need more than Twitter threads and YouTube predictions. You need smart tools.

Here are some recommendations:

- [ Website Name] Blog – Updated market insights, trend breakdowns, and token reviews.

- Messari – In-depth project analysis and metrics. Great for research.

- TokenSniffer – Helps you avoid scams and rug pulls in presales.

- DappRadar – Discover trending dApps, including PayFi and DeFi platforms.

- CoinMarketCal – Crypto events calendar to track ETF updates, token launches, and more.

Create a system where you check these regularly. It’ll save you money—and probably headaches too.

To perfect

2025 could be the year XRP finally steps out of its shadow—especially if the XRP ETF gets the green light. Combine that with promising projects like Remittix, the rise of the PayFi trend, and a renewed focus on altcoin investing, and we’re in for an exciting year.

But remember: don’t invest blindly. No matter what presale or trending altcoin you’re looking at, always ask:

- What is the actual usage pattern?

- Is there a transparent party behind this?

Are you investing because it’s trending – or do you understand it?